Banking and Financial Services

Financial institutions are subject to a slew of laws and regulations aimed at information security. While these laws and regulations do a good job of defining the scope of information security and spelling out the role of information security in risk management, they have little to say about what constitutes effective information security or how to achieve it.The Banking & Financial Services (BFS) industry continues to be transformed by technological innovation whose aims are to attain a world class structure, processes, maintenance of systems and ongoing initiative for continual improvement in the pursuit of a bank’s vision “To be a leading development financing institution operation under global best practice”. One of the main challenges of handling a project in the banking and financial sector is the integration of back-end systems being used by the bank, as well as integration with external service providers. Therefore it is highly required to identify possible potential risks like delays, failures or quality issues, need to be identified well in advance to ensure successful project implementation and thus secure financial investments.Fortunately, the International Standards Organization has developed standards that do precisely for us and by adhering to them banks can go a long way toward satisfying regulatory compliance requirements.

The Need For A Solution In The Banking And Financial Sector

Some of the major issues which, we at TRAIBCERT consider as the main thing to be addresses on the first hand w.r.t. the banking and financial sector services are:

- Business aspect: to bridge the gap between business requirements and technical specifications

- Management aspect: to shorten development time and meet the timeline of the project

- Technical aspect: to assure that performance requirements will be met on the given hardware platform.

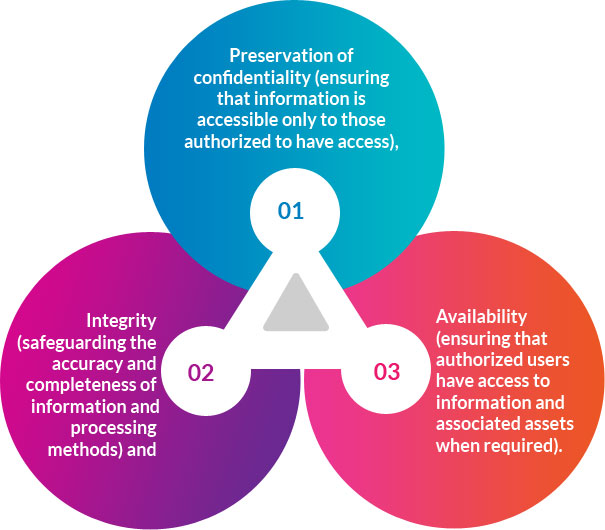

The goal of introducing common standards to this sector is to harmonizesystems and processes in order to make business transactions more efficient and enable processes that can be performed faster and more reliable manner. The standards provide best practice recommendations for initiating, implementing, or maintaining information security management systems within the banking sector which defines the

However, by successfully implementing the standards, banking and financial institutions can go a long way toward meeting their compliance requirements satisfying auditors and regulators.Measuring effectiveness is a critical element of improving information security management, and hence realizing business benefit and flexibility in a changing environment is always a challenging task.